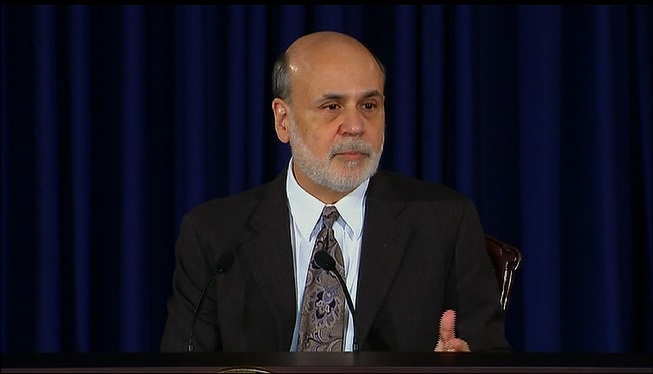

NEW YORK — (CNN) Ben Bernanke wanted more Wall Street bankers in jail in the aftermath of the financial crisis.

Bernanke advocated for Wall Street’s bailout in 2008 during the financial crisis when he led the Federal Reserve.

He still thinks the bailout was the right call, but looking back he wishes more corrupt Wall Street bankers who helped bring on the crisis went to jail.

“You can’t put a financial firm in jail,” Bernanke told USA Today in an interview Sunday. “Everything that went wrong or was illegal was done by some individual, not by an abstract firm…there should have been more accountability at the individual level.”

Bernanke left the Fed more than a year ago and his memoir, The Courage to Act, comes out this week. It is supposed to detail life inside the Fed during the worst crisis since the Great Depression.

Bernanke and the Fed drew lots of criticism from the media and general public for bailing out Wall Street at a time of great income inequality, rising unemployment and a collapsed housing market.

On Sunday, Bernanke defended his bail out decision. He also said he wished Lehman Brothers, which collapsed into bankruptcy and was portrayed as a poster child of Wall Street corruption, could have been saved.

“If we hadn’t prevented the collapse of Wall Street, then Main Street would’ve collapsed as well,” Bernanke said.

On Lehman: “We were very very determined not to let it collapse,” Bernanke said. “Unfortunately, the potential buyers for Lehman, Bank of America and Barclays, decided against buying the company because it had so much red ink on the balance sheet.”

Bernanke did admit one mistake during his tenure as Fed chair: not explaining the Fed’s actions to ordinary Americans.

He says that the public outcry over the Fed’s decision to bail out Wall Street stems from a misunderstanding and that the Fed did not do a good job clarifying its actions.

“We were so focused on trying to fix the problems, stabilize the system,” Bernanke said. “We didn’t have the time or the energy to really explain to the public to the extent that we should have perhaps exactly what we were doing, why were doing it, why it was essential for the health of the economy.”

“Even today, there’s still a lot of people who, I think, misunderstand what we did and why we did it..there’s still hostility towards the Federal Reserve, politically.”

Coincidentally, Bernanke’s book comes at a very important time for the Fed. Its committee, led by Bernanke’s hand-picked successor, Janet Yellen, could raise interest rates for the first time in almost a decade. In the interview, Bernanke didn’t comment much on the Fed’s looming rate hike decision.

Bernanke put the Fed’s key interest rate at zero in December 2008 to reboot the U.S. economy and housing market. Being at “zero bound” is considered an emergency level and some argue the U.S. economy is no longer in a crisis, nor should interest rates.

Bernanke also started a massive bond-buying program to stimulate the economy called quantitative easing, or QE.

The stimulus plan — which ended last October — sparked a 6-year bull market in American stocks and the U.S. economy has gradually improved. The unemployment rate peaked at 10% in 2009 and today it is 5.1%.

However, many Americans haven’t benefited much from the economic recovery because of stagnant wage growth. The Fed and Bernanke have been criticized by some for exacerbating income inequality, one of America’s biggest economic issues. The basic idea is that the Fed helped Wall Street bankers get richer while everyone else had to suffer through tough times.

Bernanke, who grew up in rural South Carolina, rejects any notion that he wanted to bail out Wall Street. He argues he had to do it to prevent an even worse economic downturn.

“I certainly was not eager to bail out Wall Street,” Bernanke said. “We knew that if the financial system collapsed, the economy would immediately follow.”

The-CNN-Wire ™ & © 2015 Cable News Network, Inc., a Time Warner Company. All rights reserved. (PHOTO: CNN/POOL)