Steve Burns

WMAL.com

ROCKVILLE – (WMAL) Montgomery County is joining other parts of the region, including Fairfax, Arlington, and Howard counties in allowing residents to pay their 2018 property taxes in 2017, in order to take advantage of deductions that will be going away when the new federal tax law takes effect on Jan. 1.

Councilmembers cut their vacations short in order to hold the rare special session, compressing a normally months-long process into a few hours to introduce the bill, hold a public hearing on it, and pass it.

“What we’ve done will give (residents) hopefully one more year of modest relief,” Council President Hans Riemer said.

The move is in response to a provision in the federal tax law that caps local, state, and property tax deductions at $10,000. As it goes into effect on Jan. 1, any taxes paid before then would qualify for deductions under the previous tax provisions.

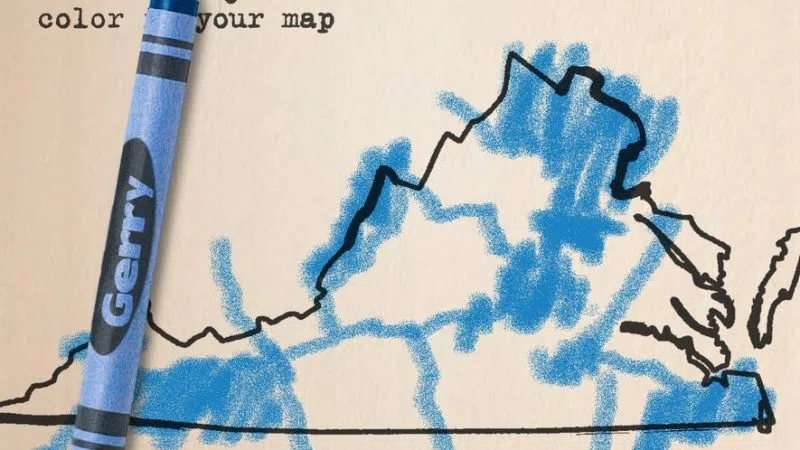

“The decision by Republicans in Congress to shred this bargain is a direct attack on blue-state communities like ours where the cost of living is high,” Riemer said.

County staff immediately got to work on a frantic outreach campaign, as tax payments, in full, must be postmarked by the time the New Year’s ball drops on Sunday night, a mere five days after the bill was passed.

That same staff had warned that the proposal was likely to only help a small number of wealthy county residents who can afford a lump sum payment, a sentiment that led Councilmember Craig Rice to become the lone ‘no’ vote on the Council.

“Guess who’s really getting the benefit from this? Folks who aren’t in this room. Folks who already are waiting, ready to sign that check with their tax accountant in their multi-million dollar homes, who already got a tax break from the Congress and the President,” Rice said, raising his voice. “That’s the part about this that stinks.”

However, other councilmembers said they had become convinced that it would benefit more than just a small swath of the super-rich.

“The volume of input that we got suggested that it was not a few. It was in fact a lot of people, and those people would be very disappointed if we did not make the option available,” Councilmember George Leventhal told reporters.

Riemer agreed, calling the measure a “middle-class tax provision.”

Leventhal also attached an amendment to the bill to “segregate” the prepaid funds, preventing the county from spending the dollars earlier than it would have had they been paid on a normal schedule.

The vote represented a political 180 for almost all of the Council. The proposal was floated by Councilmember Roger Berliner a week earlier, and was panned by other members as an uncertain, confusing, and potentially costly move. While most members had changed their minds, with the exception of Rice, concerns still remained about the effects prepaid taxes would have on the county’s bottom line.

“It clearly will reduce the income tax revenue that we get in the coming year, and I’m concerned about that,” Leventhal said. “I’m concerned that we may rue this vote.”

Rice predicted cuts to programs and organizations that benefit vulnerable populations, like homeless services.

“A lot of the people that I represent are not going to be helped by this measure, and in fact, the cost to this county, while some have said is potentially insignificant, actually is significant,” Rice said. “I don’t support doing it on the backs on some of the other people in this county that are struggling.”

Riemer downplayed the potential impacts, saying “a sliver” of income tax revenue will be reduced, while providing a “wallop of tax benefits” to county residents.

It comes as the county learned that tax revenues for the current fiscal year are running $64 million under projections, forcing officials to take up a savings plan first thing in 2018. County Executive Ike Leggett told the County Council earlier in the month that the shortfall is expected to top out at about $120 million.

Characterizing the criticism he has received both for supporting the measure and for waiting too long to take it up, Leventhal called it “the joy of being an elected official. You will be criticized no matter what you do, 100 percent of the time.”

Copyright 2017 by WMAL.com. All Rights Reserved. (Photo: Pixabay/ CC0 Creative Commons)